STRIV services are different

than most CPA firms.

Industry-wide, the typical CPA firm receives the majority of its revenues from financial audits, often for government entities— a very different world than small business ownership. STRIV does NOT prepare financial audits.

At STRIV we focus on entrepreneurs and CPA services designed specifically for them in 2 areas:

Outsourced Accounting and Tax Planning and Compliance

Outsourced Accounting

What do we cover?

From Bookkeeping (data entry, A/R, A/P) to Controller oversight to CFO (strategic planning, financing, and projections) we have a qualified team of accounting professionals at every level and at flexible hours as you need them month-to-month. We can adapt and grow with your business so you can focus on what you are best at and enjoy the most.Why outsource your accounting?

Having Timely, Accurate, Complete (“TAC”) accounting data is critical for entrepreneurs to understand how their business is performing and to make good decisions. “TAC” is also the foundation for STRIV: we provide the best tax planning service to minimize the owner’s tax liability.

Because business owners do not have time to recruit qualified accounting staff and then onboard, train, and manage them. Often their businesses are growing quickly and their accounting needs change often, making it more difficult to have the needed accounting staff.

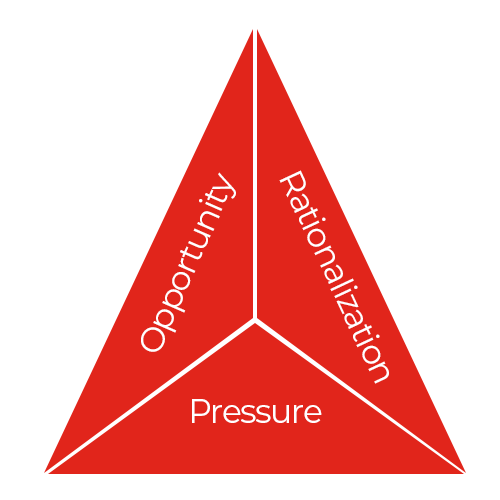

Having outsourced accounting oversight prevents embezzlement. It breaks the “fraud triangle”: There will be fraud eventually if 3 elements are present: Financial Pressure, Rationalization, and Opportunity. The element that employers have control over is Opportunity—which outsourcing helps eliminate.

Tax Planning and Compliance

What is it?

Income tax planning for owners and their businesses is a coordinated effort that builds on the foundation of TAC accounting (Timely, Accurate, and Complete)

Tax compliance services, all at the federal level and in all 50 states, include:

-

Income tax returns, all business tax returns

and individual tax returns - Payroll tax returns

- Sales tax returns

Why outsource your tax planning and compliance?

You are not a Certified Public Accountant. Tax laws change often and are complicated. Outsource to STRIV who are proactive experts at entrepreneurial taxation and know the aggressive strategies to take to mitigate your tax burden.

As your income goes up, your tax burden grows at an increasing rate, since federal income tax bracket percentages increase from 0 to 37%. Even small tax planning adjustments can generate significant tax savings. Those tax savings increase as you your tax rate increases.